Crypto founders are often looking for strategies to address tax efficiency, asset protection, and diversification.

We often talk with these founders to create blueprints that include several strategies, which can change over time.

When addressing tax efficiency, we have to look at both income taxes and estate taxes. You pay income taxes during your life on the money you earn. Your heirs pay estate taxes on the wealth you leave behind.

The Roth IRA is one of the tools we can use to address the income tax issues.

The Traditional IRA

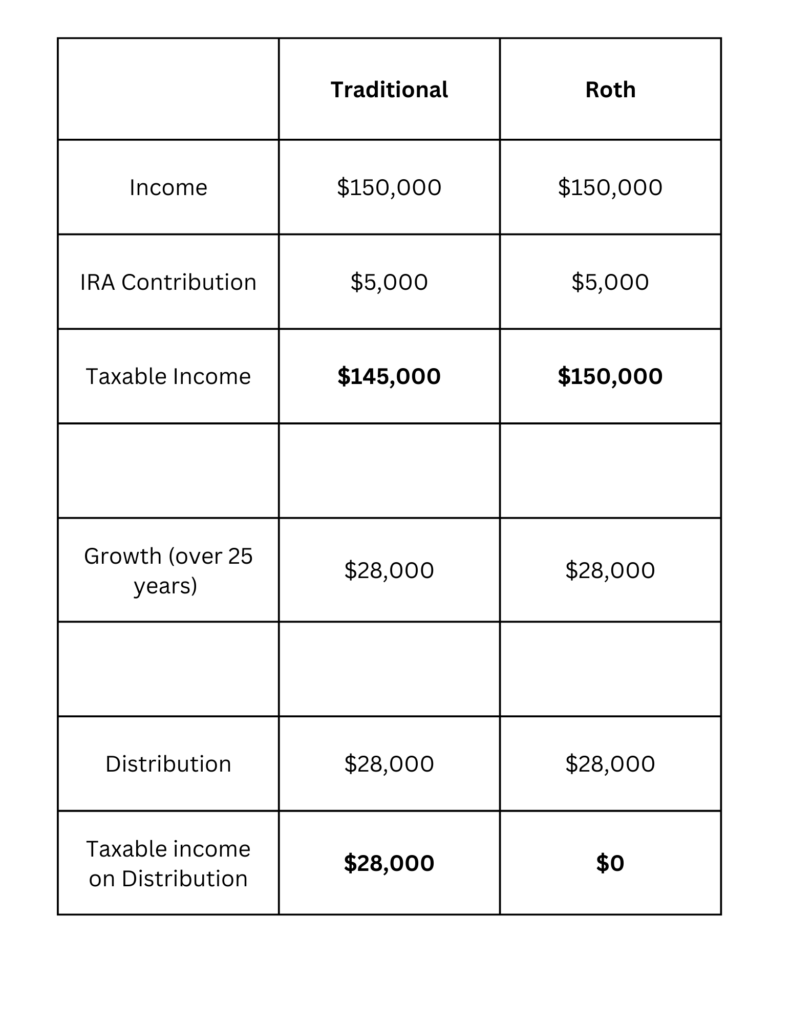

The traditional IRA (Individual Retirement Account) was created to help Americans save for retirement in a tax-efficient manner. Money could be saved into an IRA before being taxed. As the investment in the IRA grows, it is not subject to capital gains tax. However, when you start taking money from the IRA, as most Americans do during retirement, it is taxed as ordinary income – like you’re receiving a paycheck.

So, if I contribute $5,000 to my IRA this year, I can deduct that $5,000 from taxable income for the year. I invest that money and it grows tax-deferred over my working life. That $5,000 might grow to over $28,000 after 25 years.

If I then take that money from my IRA because I want to pay my bills, I would be taxed on the $28,000 as ordinary income, just like if I received it in a paycheck.

Roth IRA

The Roth IRA flipped those tax consequences. If I contribute the same $5,000 to a Roth IRA, the $5,000 is included as part of my taxable income this year. I invest the money and it grows to the same $28,000 over 25 years.

When I take my distribution at retirement, I do NOT include it in my taxable income for the year.

So, why wouldn’t I do this with all my money? Of course, there are rules.

The Rules

All IRAs have annual contribution limits.

The money in a Roth IRA cannot be taken out until age 59 ½ without a stiff 10% penalty plus tax on the growth.

I mentioned asset protection and estate planning earlier. Roth IRAs are not protected for liability purposes. If I get sued, my Roth IRA assets are fair game.

The Roth IRA assets are also included as part of my estate. When I die, the value of the Roth IRA is added to the rest of my assets to determine any estate tax owed by my heirs.

A Valuable Tool

The Roth IRA is a valuable tool for mitigating income and capital gains taxes. This is particularly true for appreciating assets like crypto tokens, and especially for founders who can move very low value token warrants into the Roth IRA.

They pay taxes based on the value of warrants or low value tokens, and allow those token values to grow tax-free for the rest of their lives.

As we stack strategies to mitigate income tax, estate tax, asset protection, and diversification, the Roth IRA for company founders is a great strategy and vital part of the blueprint.